Town Notices

Public Notice Monday July 15, 2024

- Details

- Published: July 12 2024 15:41

PUBLIC NOTICE

On Monday July 15, 2024 The following areas of the Town of Digby maybe affected with an interruption of water service starting Monday morning into Monday afternoon to allow for a repair.

Third Avenue from Mount Street to Warwick Streetand The south side of Mount Street (those with temporary water service lines)from Victoria Street to King StreetYou may experience water pressure fluctuations and discoloration of water once the water service has been restored.

Sorry for any inconvenience this may cause For further information contact Town Hall 902-245-4769

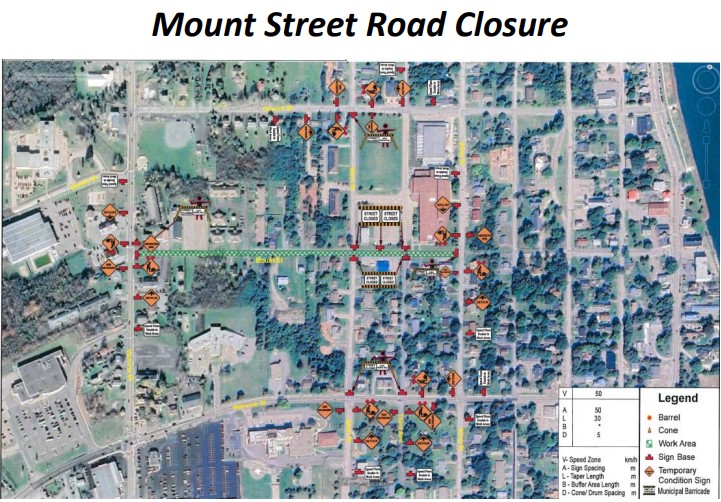

Mount Street Road Closure Map

- Details

- Published: June 24 2024 10:07

Our Town Newsletter - June 2023

- Details

- Published: June 12 2023 09:40

Canada Day BBQ, Summer Festivals, and more summer activities!

Town of Digby 2021/22 Operating Budget

- Details

- Published: August 23 2021 16:33

Our Town Newsletter Volume 1 Issue 3

- Details

- Published: August 11 2021 16:27

Notice of Half - Masting of Flags

- Details

- Published: July 14 2021 13:33

Masting Period: From now until further notice.

Occasion: DISCOVERY OF REMAINS AT FORMER RESIDENTIAL SCHOOLS

Town of Digby Parks

- Details

- Published: May 01 2020 16:22

PUBLIC NOTICE

As of 8:00 AM Saturday May 2nd 2020 the following parks will be open:

• Fishermen’s Memorial Park (excluding the children’s play equipment)

• Town of Digby Dog Park

• Promenade/look off

• Digby Centre

People are still reminded to adhere to all public health guidelines.